17 QUESTIONS YOU MIGHT HAVE ABOUT GST REFUND FOR TOURIST IN MALAYSIA

With effect from 1st April 2015, Goods & Service Tax (GST) will be implemented throughout Malaysia. Thus, tourist to Malaysia can apply for GST Refund on eligible goods purchased in Malaysia when they leave the country. Here are 17 commonly asked questions about the Tourist Refund Scheme (TRS).

#1 What is TRS?

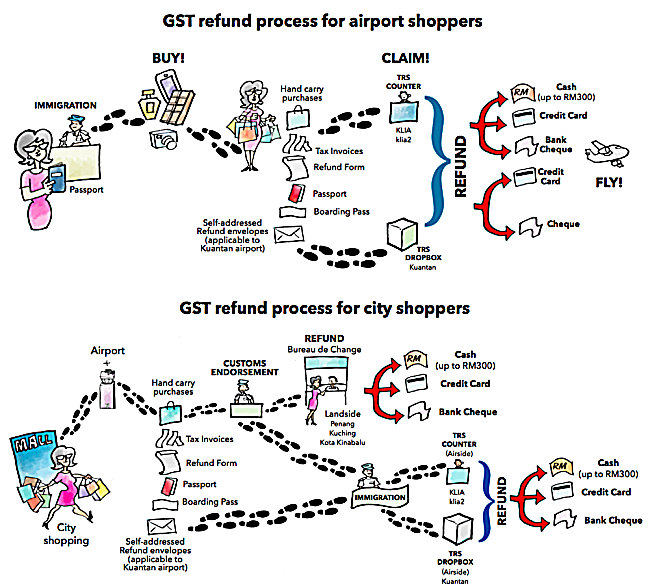

TRS allows tourist to claim a refund of the GST they paid on eligible goods purchased from Approved Outlets (shops that participate in the TRS) if the goods are taken out internationally from Malaysia by air from one of the airports in Malaysia managed by Malaysia Airports. If you buy in shops that do not participate in TRS, you’ll not get any tax refund.

#2 How do I know which outlets is an Approved Outlet for TRS?

Retailers participating in the TRS will display a “TRS logo” at their retail shop. Tourist can look out for the logo or check with the retailer if their purchases are eligible for GST refund.

#3 Who are eligible for TRS?

To be eligible for a GST refund, you must satisfy all of the following criteria:

- You’re NOT a Malaysian citizen or permanent resident of Malaysia

- You hold a valid international passport

- You’re not a member of the crew of the aircraft on which you’re departing Malaysia

- You must take the goods out of Malaysia by air within 3 months of purchase

#4 What if I’m here on a student pass? Am I entitled?

Yes, provided that you’re non-Malaysian and is not a permanent resident of Malaysia. Student pass holders are treated as normal foreign tourist and are eligible for GST refund if you fulfil all the criteria.

#5 Are Malaysians eligible for a refund under TRS?

Are you kidding? Obviously not. Please re-read #3.

#6 Can I claim tax refund for everything I buy? If not, what are the goods that are exempted for a refund?

GST refund is only applicable to Approved Outlets bearing the “TRS logo” and applies to only eligible goods. You may claim refund on the GST charged and paid on goods purchased from an Approved Outlet, except for the following:

- Wine, spirits, beer and malt liquor

- Tabacco and tabacoo products

- Precious metal and gem stones

- Goods wholly or partially consumed in Malaysia (except for clothing/tax invoices to be maintained)

- Goods which are absolutely prohibited from export under the writer law

- Goods which are not taken out as accompanied (hand carried) or unaccompanied (checked-in) luggage

#7 Can refund be claimed for services such as accommodation, car rental and entertainment?

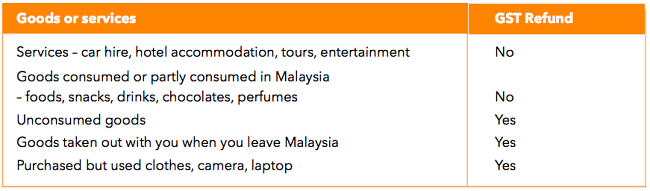

GST refund is not applicable for consumable goods and services such as hotel accommodation, entertainment, car rental, etc.

#8 Can tourist use the purchases before applying for TRS?

Purchases that have been used, wholly or partly, will not be eligible for GST Refund – except for non-consumable goods such as clothing, camera and laptops. Tax invoices for non-consumable goods must be maintained.

#9 What must I do at the Approved Outlet?

- You must show your valid international passport to prove your eligibility

- Inform the outlet that you intend to leave Malaysia via air within 3 months from date of purchase

- Obtain and keep the original tax invoice/receipt for your eligible purchases

- Get an original Refund Form from the sales assistant/cashier at the Approved Outlet and ensure that the refund form is completed correctly

- Complete the Refund Form, which is in triplicate. The Form must be completed by you personally and NOT by a representative

- The tourist must keep the original copy of the tax invoice or receipt and the completed original Refund Form and produce these documents together with the purchased goods to a Customs Officer at the airport prior to departure

- If you want to mail in your Refund Form, get a self-addressed envelope with pre-paid postage from the Approved Outlet

#10 Is there a minimum amount for the refund?

You must spend at least RM300 (including GST) to be eligible for refund. You claim for tax refund must be supported by the relevant tax invoices or receipts and Refund Forms.

#11 Is there a time limit on the purchases under the TRS?

Yes, as mentioned, your purchase should not be more than 3 months from your date of departure in order to be eligible under TRS.

#12 Where do I get my Refund Form?

You can get it from the Approved Outlet where the eligible goods have been bought. A Refund Form cannot be issued by the Customs at the airport.

#13 What information do I need to provide on the Refund Form?

The refund form should contain the following particulars:

- Tourist’s name

- Tourist’s passport number

- Tourist’s country of residence

- Date of arrival in Malaysia

- Intended date of departure from Malaysia

- Date of purchase of the eligible goods

- Tax invoice or receipt number for the eligible goods

- Description and quantity of the eligible goods purchased

- The total amount paid for the eligible goods, inclusive of GST, the total amount of GST refundable, the amount of the administrative/processing charge/fee and the net amount of GST refundable to the toutist.

#14 What documents must be presented during a refund?

- You must show your valid international passport

- Your boarding pass or confirmed air ticket as proof of departure

- The goods purchased (jewellery must be in sealed plastic bags)

- Your completed Refund Form for your purchases

- Your tax invoices/receipts

#15 Where do I obtain my refund at the airport?

Once you have completed your Refund Form(s) and the form(s) are endorsed by the Customs, you can apply for your GST refund at the TRS counters located at the respective airports before you check-in your purchases. It’s important for you to arrive at the airport early to allow sufficient time for processing of your GST Refund and inspection of goods.

#16 Will I be charged a handling fee?

Yes, you’ll be charged a handling fee and it’ll be deducted from the GST amount due to you. It means that you’ll not receive the full amount of GST as refund. GST Refund is made in Ringgit Malaysia at the prevailing exchange rates.

#17 What’s the currency used for GST Refund and what are the payment methods?

Your refund will be made in Ringgit Malaysia (minus the Agent handling fee). You may choose to have your refund in cash (up to RM300) or to a credit card account or through a bank cheque if neither of the previous refund options is feasible.

(Content sources: Malaysia Airports and GST Customs)