25 MARCH 2015

GST EFFECT: DOMESTIC TRAVEL VS. INTERNATIONAL TRAVEL

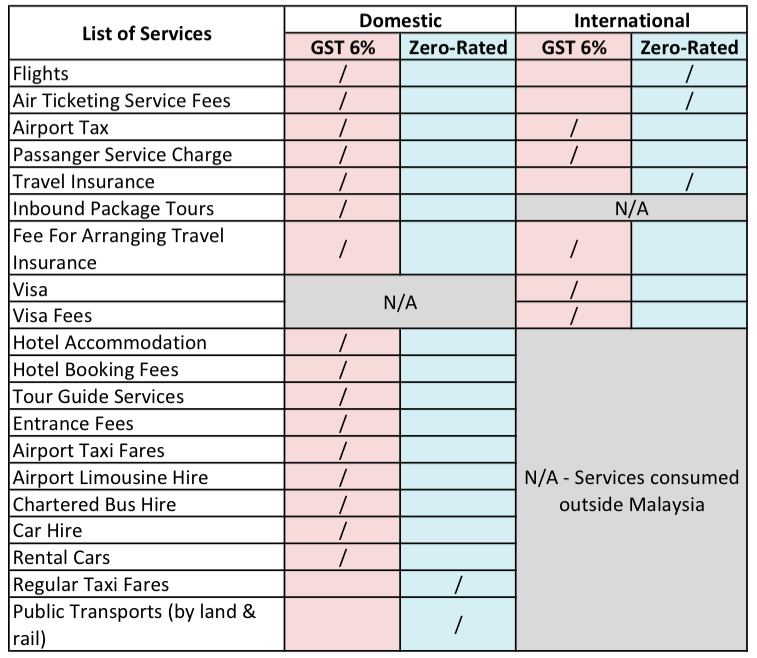

Most of our spending goes towards transport, accommodation and dining when we travel. An Industry Guide published by the Royal Malaysian Customs Department defined the application of GST in the travel industry and here’s how we, as a consumer, will be affected it when you travel Domestically and Internationally from April 1, 2015.

GST Effect on the cost of your holidays

*Amended and updated on 26 March 2015

A few other things…

- If a local travel agent has commissioned another travel agent to run an inbound package, GST will be charged on the commission payable.

- GST on Domestic Travel is quite straightforward.

- GST on International Travel will have both standard-rated (6%) and zero-rated elements especially in tour packages. (Eg: the price package for London will be zero-rated but GST will be imposed on commission, airport tax and the passage service charge.)

- No news on airlines absorbing the GST for local flights, thus domestic flight tickets will cost more from April onwards.

Know what you are paying for, it's up to us to understand how GST works.

(Content source: The Rakyat Post)

Editor

READ RELATED

With One Well-planned Trip, You Can Experience The Magic Of Eight Different Countries, Each Offering Its Own Unique Charm. From Majestic Castles To Turquoise Lakes, This Adventure Will Leave You With Unforgettable Memories And An Overflowing Photo Album. Here's A Guide To What You'll Discover In Each Stunning Stop:

05 JUNE 2025

Vietnam Is A Land Of Captivating Beauty, Rich Culture, And Historical Significance. From Its Bustling Cities To Serene Landscapes, The Country Offers A Plethora Of Experiences For Every Type Of Traveler. Here Are Some Essential Destinations That Should Be On Your Vietnam Travel Itinerary.

27 DECEMBER 2024

During Halloween, A Time Where Ghosts And Pumpkins Coexist, Decorations Start To Adorn Places Around The Globe In Preparation For This Festive Night. Let’s Explore Those Countries That Come Alive With Excitement During Halloween And Experience Their Unique Celebration Styles!

14 OCTOBER 2024

There More Thing That Just Food In Hong Kong.come Experience The Into Hong Kong’s History, Traditions, And Creative Arts, Providing A Memorable And Enriching Adventure.

26 AUGUST 2024

Experience Hong Kong’s Culinary Delights: Iconic Dim Sum, Street Food Gems, And Traditional Dishes Like Roast Goose And Egg Tarts. Ready?

06 AUGUST 2024

Chongqing Has Attracted Countless Tourists With Its Unique Title Of "5d City." So, What Exactly Makes Chongqing A "5d City," And Why Is It A Must-visit Destination? Let's Uncover The Mysteries Of This City And Explore More Must-see Attractions And Local Delicacies.

25 JULY 2024

Switzerland: A Land Of Precision, Beauty, And Cultural Riches

25 JUNE 2024

Australia Has Something For Everyone Stunning Landscapes, Bustling Cities, Rare Wildlife, And A Vibrant Culture.

20 JUNE 2024